2023 Climate Impact & Personal Finance Guide - Saving Preview

...plus, our new Slack community and new ways to invest in climate!

👋 17 new community members!

📖 4 min read time

Most people who find Intention are looking to answer the exact same question:

“How do I invest my money in a climate-friendly way?”

This is the wicked problem that we are dedicated to answering on a weekly basis through our newsletter and future climate investing platform. However, we know that some of you are antsy and maybe just want the TLDR. That’s why we’re putting together the best short-cut, cut-the-crap, one-stop guide for all of your climate investing needs. And today, you get a preview!

👀 But first… announcing our Climate Investing Community on Slack!

Many of you have asked for a more intimate space to discuss climate investing, so we’re making a Slack community! Comment if you’d like to be a beta tester while we work out the kinks; otherwise, look out for an invite in the coming weeks!

2023 Climate Impact & Personal Finance Guide (Saving Preview)

If you’re looking for ways to have climate impact with your money, you can think about what you can do in 4 distinct categories: saving, spending, investing, and donating. Our guide assembles the current best-in-class options within each category. This week, we’re going to give you a sneak peak at the recommended ways to save.

Saving

The purpose of a bank is to safely store deposits, then pool that money to lend to people and companies that want to take on substantial projects or assets.

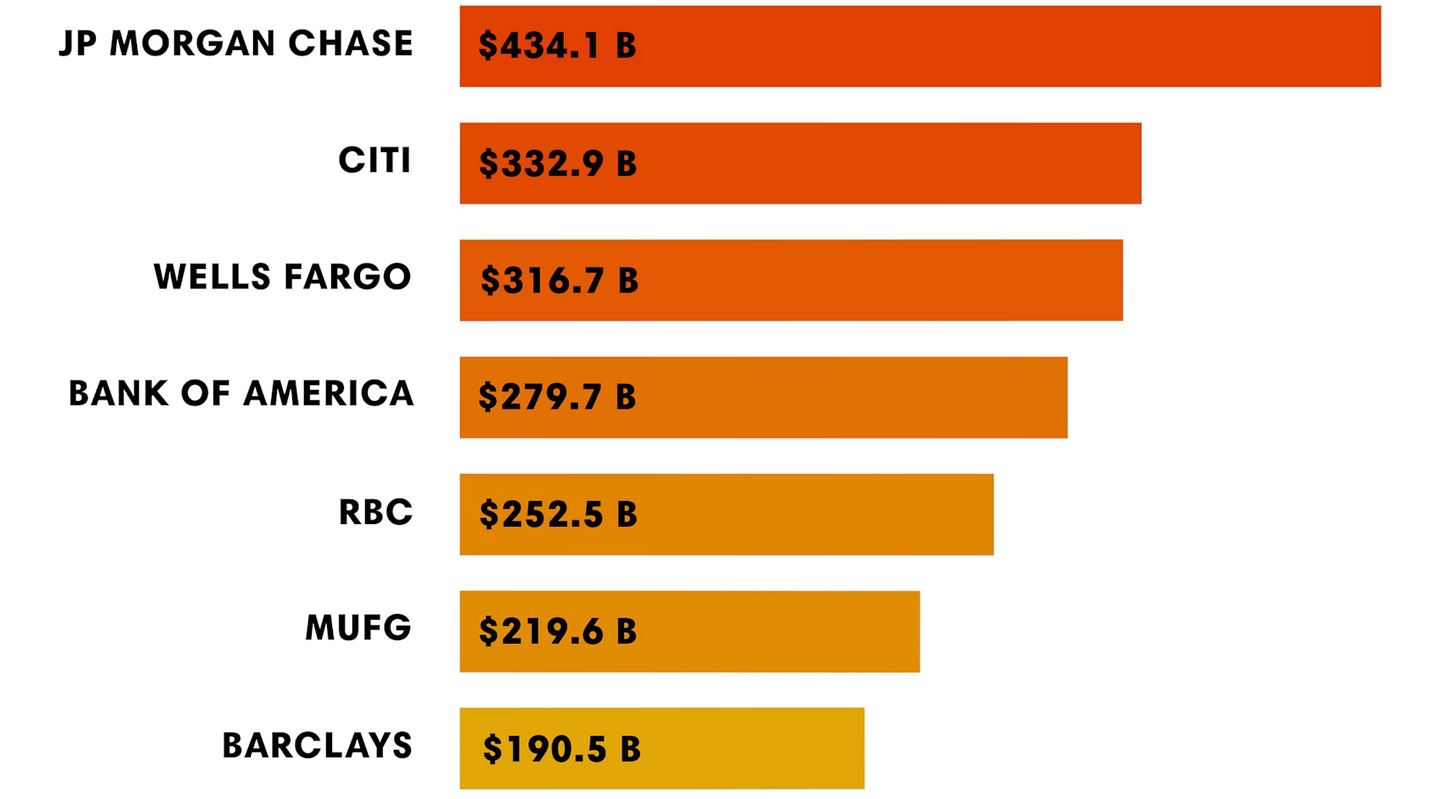

The vast majority of banks lend based only on financial returns. You’re probably here because you don’t love the past consequences of that. Every major bank lends to fossil fuel companies, and while no one should expect banks to completely divest from oil & gas, these banks aren’t doing enough to divest when possible.

However, there are a few banks that are prioritizing the environment by financing climate-related projects:

This isn’t an exhaustive list but it captures notable players in the banking industry at the moment according to reputable organizations that vet financial products (GP, B4G, NW, AS). There are also banks like VA Community Capital that are doing great work but are a little too small or aren’t consumer-facing enough to feature right now.

We’ll continue to refine this list over time and hope to add more banks as more commit to climate impact! Are we missing a bank that deserves to be mentioned in our guide? Let us know in the comments section👇👇👇

Look out for next week’s newsletter, where we’ll sneak a preview of the giving category in our 2023 Climate Impact & Personal Finance Guide.

📈 New ways to invest in climate

What’s new since last week’s newsletter. Disclaimers: selection based on company description but impact not assessed. Not investing advice.

Flower Turbines ($125M valuation, common stock): Innovative small wind turbines.

GeoSolar Technologies ($10M raise, common stock): Tomorrow begins today with GeoSolar Technologies' SmartGreen™ home.

ZenniHome ($75M pre-money valuation, common stock): Transforming the $2T US housing market with robotic smart homes.

Zergratran ($75M raise, common stock): Creating an alternative zero-emission shipping route through a tunnel under Northern Colombia.

New climate investing/finance podcasts

Smart Money: Investing (and Banking) For a Greener World

👇 see you in the comments section👇

What’re you investing in this week? Let the community know below.