Today, we’re excited to release the Climate & Money Resource List, our long-promised, cut-the-crap list of climate finance options. It took a bit longer than expected but all good things take time!

If you're reading this, you probably asked some variation of "How can I have the most climate impact with my money?"

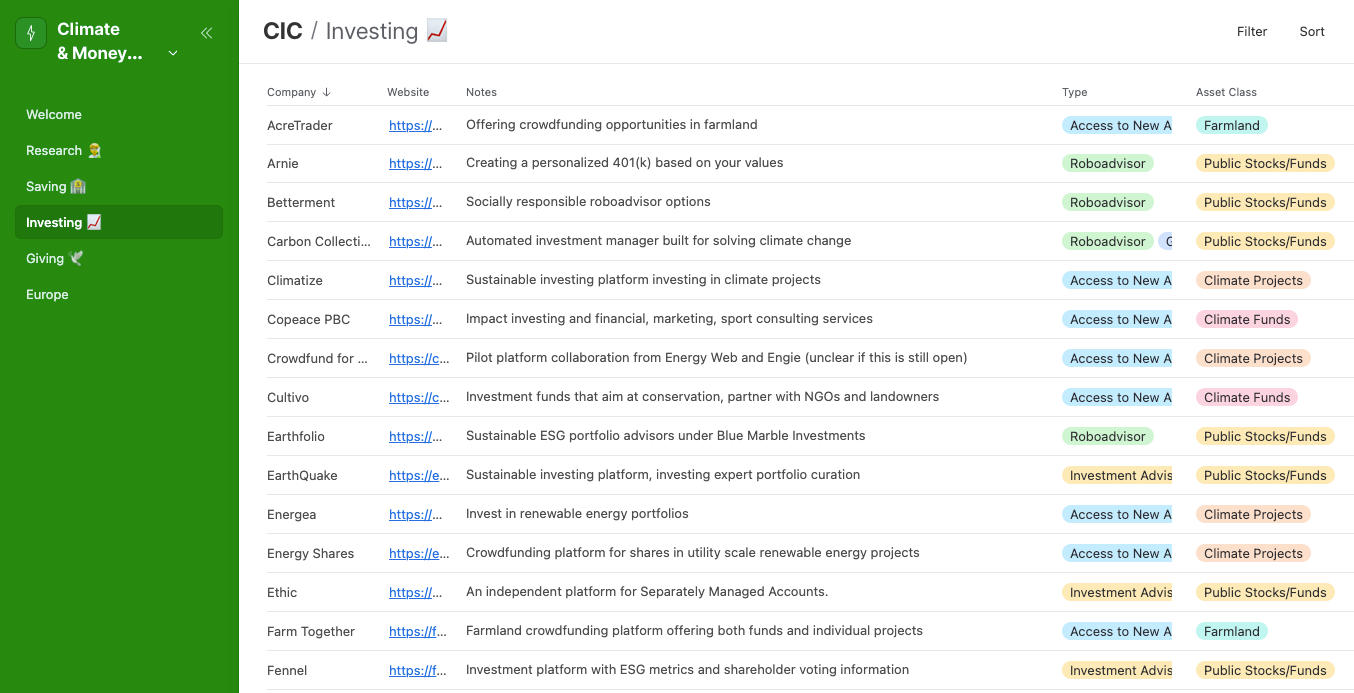

To answer this question, we’ve created the Climate & Money Resource List, a quick but detailed list of climate-friendly options for your personal finances. Investing in climate is still niche, so options are fairly limited. We're eager for the day that this spreadsheet buckles under the sheer amount of opportunities.

*please note that this resource is best viewed on desktop

This list is divided into a handful of distinct categories:

Research 🧑🔬 - great resources to conduct personal climate finance research

Saving 🏦 - make sure your savings are banked in climate-friendly ways

Investing 📈 - find climate ETFs and invest directly into climate startups/projects/stocks

Giving 🕊️ - fund effective philanthropic climate organizations

Spending 💸 (coming soon) - buy green appliances, vehicles and other products

Europe 🌍 - climate finance for our European friends

We aim to show you the lay of the climate investing landscape, with *minimal* bias. However, a category like giving does indeed get too big too fast -- there are 1000’s of climate non-profits. In such cases, we highlight organizations that Giving Green and other charity navigators think are the best of the best, and then we give you some tools to look at the rest.

We update this spreadsheet often, but at the very least quarterly. Is this list missing something? Make your pitch on the CIC slack channel #greenportfolio!

🤔 "How do I actually do this?"

Most people "green their portfolio" in the following steps:

Buy green appliances, solar panels, EVs, etc

Roll-over 401(k) or mutual funds to a climate mutual fund or ETF

Transfer savings/checking to a green bank

Invest in climate projects, startups and stocks

Donate to climate charities

Like all good things, this transition takes a little time and effort. Needless to say, our members in the Climate Investing Community are a great support system as you navigate these changes!

Speaking of which…

🛜 CIC Slack news: Events, events, events!

Another big thanks to Daniel Krioziere for joining us for last week’s discussion on the current state of the climate capital stack, which you can find the video of here. We’ve got a full slate of events ahead of us:

Sept 26: AMA w/ WattCarbon's McGee Young

Sept 29: Convo + AMA w/ Grid United’s Michael Skelly

Oct 3 (just added): Sustainable Finance Group Discussion

Oct 5 (just added): AMA w/ Steward's Dan Miller

Oct 12 (rescheduled): Climate-Friendly Financials AMA w/ GreenPortfolio

📈 New ways to invest in climate

What’s new since our last newsletter. Disclaimers: selection based on company description but impact not assessed. Not investing advice, DYOR.

EWM ($12M valuation, common stock): EWM’s processes drive affordable water creation using sustainable desalination that recovers water and minerals for beneficial use.

Libi Materials ($20M post-money, SAFE): Increasing the energy density of lithium-ion batteries 35-40% to extend the range of EV’s.

Orange Bike Brewing Company (1.6x multiple, revenue sharing note): Making world-class beer with a focus on the triple bottom line.

This is a GREAT list – super handy! Congrats!!

On seeing the word "spreadsheet" I immediately thought, "it'd be great if this could be put in Airtable." And then, when actually looking at the spreadsheet ... ;)