Giving Preview - 2023 Climate Impact & Personal Finance Guide

...plus, our new Slack community and new ways to invest in climate!

👋 34 new community members!

📖 7 min read time

Once you’ve consider how to save your money for impact, which we covered two weeks ago, you naturally start to analyze other parts of your financial life. Today, we’ll talk about maximizing impact via giving.

These are the wicked problems that we are solving on a weekly basis through our newsletter and future climate investing platform. However, we know that you may just want the TLDR. That’s why we’re putting together the best cut-the-crap, one-stop climate investing guide.

2023 Climate Impact & Personal Finance Guide (Giving Preview)

If you’re looking for ways to have climate impact with your money, you can think about what you can do in 4 distinct categories: saving, spending, investing, and giving. Our guide assembles the current best-in-class options within each category. This week, we’re going to give you a sneak peak at the recommended ways to give.

Giving

If you spend, save and invest well, you may be fortunate enough to donate some of it! Giving money to philanthropic organizations is how many people chose to help the environment.

Over the last several years, the philanthropy sector has undergone radical changes.

Once upon a time, a charity’s effectiveness was judged by its ability to limit overhead costs. Impact was important but individual projects were often too difficult to measure. However, thanks to a monumental increase in data, we can now monitor and assess the performance of charitable projects like we would financial investments.

In 2007, GiveWell started to analyze the impact of charitable projects using rigorous scientific studies and in-depth research. We’ll spare the gory details but the organization was one of the first to attempt to truly quantify impact of charitable projects, to be able to confidently say “this amount of money has this amount of impact.” This process, generally thought of as effective altruism, is very similar to impact investing.

Don’t believe us?

The questions that GiveWell asks to assess a project’s readiness for funding look a lot like impact investing:

Is there evidence of effectiveness and transparency? In impact investing, we call this intentionality and measurability.

Is it cost effective? In impact investing, we call this expectation of return.

Is there need for more funding i.e. would the project exist or scale without this extra funding? In impact investing, this looks a lot like additionality.

What does this have to do with giving for climate impact?

There are many different types of charities. Global poverty, human health & development, veterans welfare... how can we go about comparing apples and oranges?

Well, one way is to separate the apples from the oranges, which is exactly what Giving Green does. The organization, which was inspired by GiveWell, only evaluates climate projects, and they do that very well.

Another organization, Founders Pledge, also performs rigorous climate evaluations, with a slight preference for obscure or higher risk projects given its origins as a giving pledge for tech startup founders/investors.

These are the two charity evaluators that we point to when people ask us where they should donate. Their approach to grant-making, simplified:

Fund projects that are proven (via measurement) to have robust climate impact

Fund projects that are underfunded and could potentially have a large impact

So which charities do these two trusted organizations recommend?

Here are the organizations that Giving Green and Founders Pledge currently recommend:

Right now you’re probably thinking “Uhhh I don’t recognize any of these charities… what gives?”

Where’s the Sierra Club, WWF, Green Peace, Nature Conservancy? These charities do great work. However, as legacy environmental orgs, they’re not quite optimized for climate action. Furthermore, they have plenty of funding, so donating to them lacks the world-beating impact that we’re looking for!

Here’s what Giving Green has to say:

Solving the climate crisis requires systemic change: changing the laws, norms, and systems that make greenhouse gas emissions part of everyday life. In practice, this means advocating for strong climate policy and advancing climate technology. These are areas where climate donors can have an outsized impact by connecting their individual action with systemic change.

That’s why we believe the highest-impact giving opportunities for climate donors is to donate to climate nonprofits that work directly on policy advocacy and technology advancement. We estimate that top giving opportunities in policy and technology are an order of magnitude more effective than the best direct emissions reductions projects, such as carbon offsets.

To be clear: if you want to donate to a local land trust or WWF, do it! We’re simply showing you what goes into making an informed decision on impact giving.

That being said, making an informed decision is very difficult.

That’s why we lean on trusted charity evaluators. It’s worth noting that both Giving Green and Founders Pledge have their own charitable portfolios that they manage themselves. That way they can direct your donations in the time and manner they think is best as subject matter experts. This is akin to investing in a managed VC fund rather than a single company.

These are particularly great options — they diversify risk/reward, and moreover, allow the people who know best to allocate funds appropriately.

Look out for next week’s newsletter, a 3rd preview of our 2023 Climate Impact & Personal Finance Guide.

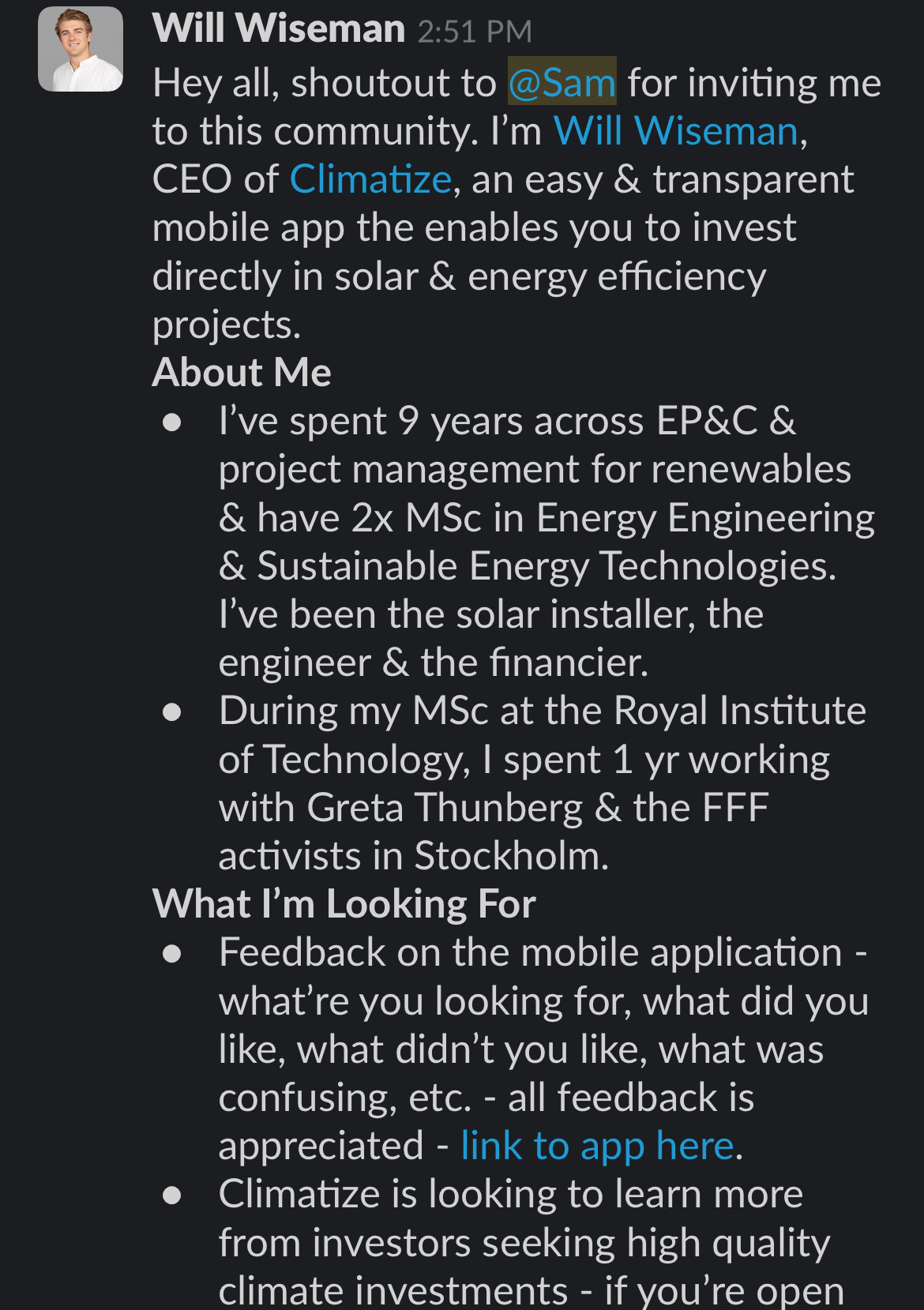

CIC Slack news: Climatize CEO asks for your feedback!

Our CIC members are already talking and taking advantage of the new group. Will Wiseman of the recently launched Climatize app asks if you’d so kindly check out their app.

We’re looking forward to facilitating many more connections like these! If you haven’t already, sign up for the Climate Investing Club here!

📈 New ways to invest in climate

What’s new since last week’s newsletter. Disclaimers: selection based on company description but impact not assessed. Not investing advice, DYOR.

Calvert Impact Cut Carbon Note (5-6.5%, green bond): secured, investment-grade rated, fixed-income product that finances sustainability upgrades for commercial buildings, with the objective of reducing carbon emissions.

New climate investing/finance podcasts

Financial Climate w/Alex Roth: #13 Climate risk expert Emilie Mazzacurati

👇 see you in the comments section👇

What’re you investing in this week? Let the community know below.